restaurant food tax in pa

The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax. The sales tax rate is 6.

Best Local Restaurants In Mountain Top Pennsylvania Oct 2022 Restaurantji

Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when.

. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent. Depending on the type of business where youre doing business and. V D department store a nonfood retailer operates a restaurant located on its premises.

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Examples of dealers are delis restaurants and grocery stores as well as hospitals schools nonprofit groups and. Get a Food Establishment Retail Non-Permanent Location License.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. This page describes the taxability of. What is the tax on restaurant food in Philadelphia.

Instead the restaurant or retailer treats it as a sales tax-exempt sale for resale. Exact tax amount may vary for different items. Retail food facilities are governed by Title 3 of the Consolidated Statutes Chapter 57 - Food Protection 3 CSA.

In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out. The Liquor Tax is applied to the sale price of alcoholic beverages purchased at bars restaurants catered events and at retail stores. The sale of equipment implements other than wrapping supplies and similar tangible personal property to a restaurant for use in the preparation or.

A Pennsylvania Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Of the ticket is subject to the sales tax unless the price charged for food service is stated separately from the other items. The restaurant or retailer does not collect sales tax from the business on the cost of the food.

Sale of equipment to restaurants. Groceries clothing prescription drugs. All Retail Food Facilities are regulated by The Food Code.

The restaurant menu includes appetizers salads entrees side dishes desserts and beverages. The current rate is 10. We have a certain amount of food items that are comped each day for managers owners and possibly.

SALES TAX IN THE RESTAURANT INDUSTRY WHAT IS TAXABLE. 7272 states that the department or any of its authorized agents are authorized to examine the books papers and records of any taxpayer in order to verify the accuracy and. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals.

I own a restaurant in Pa Beaver County. Andor sold by a qualified nonprofit organization as a. Any entity that sells food or other taxable items in PA must register for and display.

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

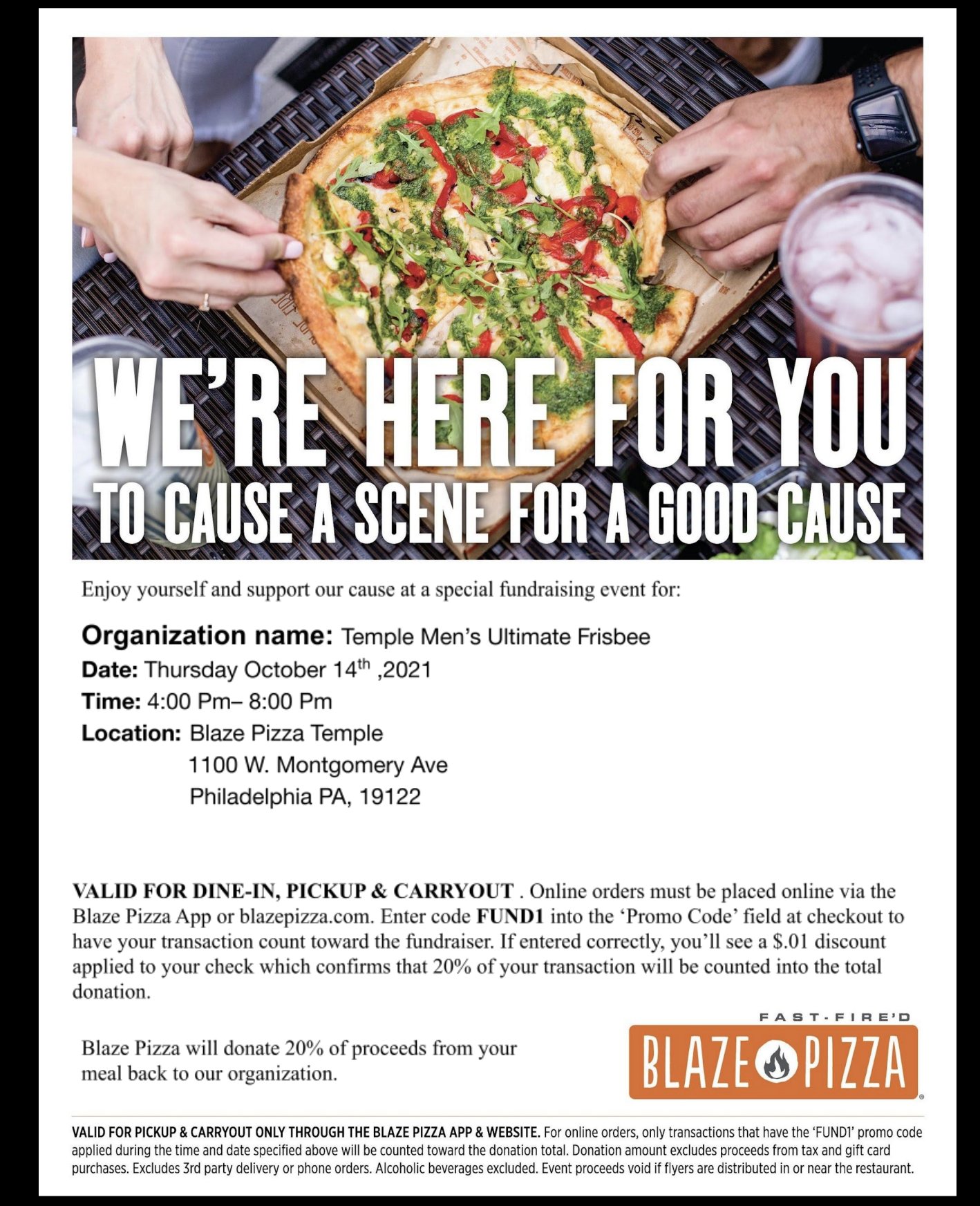

Temple Men S Ultimate On Twitter Our First Fundraiser Is At Blaze Pizza On Temples Campus Come Join Us And Eat Some Food Make Sure You Say Youre With Temple Men S Ultimate When

The Importance Of Restaurants To Local Community Cumberland Area Economic Development Corporation

Online Menu Of Three Brothers Grill Restaurant Reading Pennsylvania 19601 Zmenu

Rizzo S Malabar Inn Crabtree Pa Stuffed Shells Drive Thru Special Thursday 7 23 Starts At 3 30 Facebook

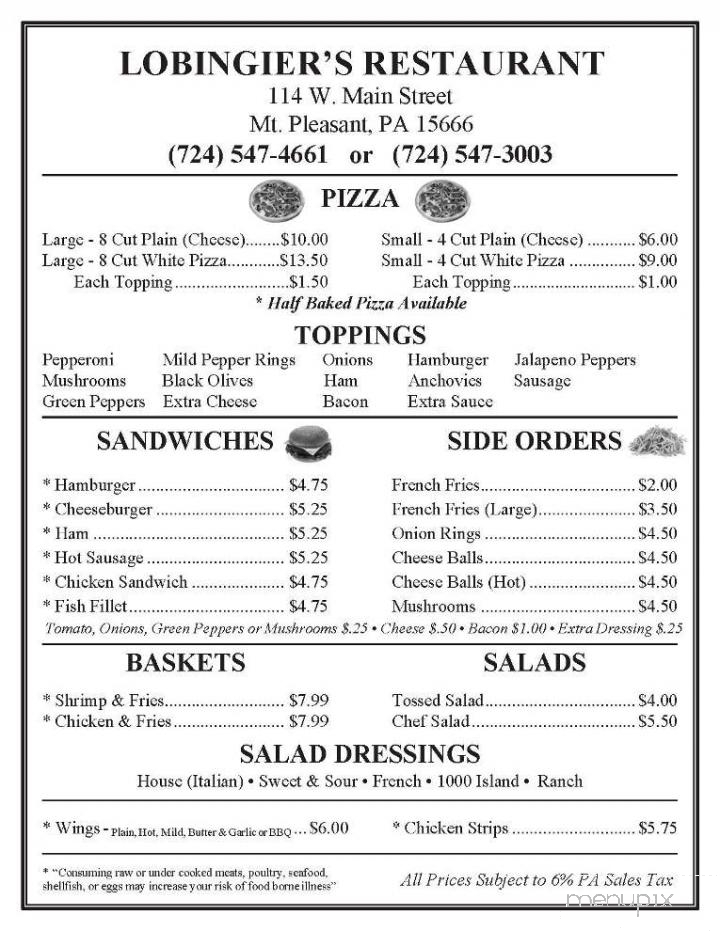

Menu Of Lobingier S Restaurant In Mount Pleasant Pa 15666

Everything You Need To Know About Restaurant Taxes

Everything You Need To Know About Restaurant Taxes

Permanent Stone Inn Galeton Restaurant Reviews Photos Phone Number Tripadvisor

Estia Greek Restaurant Greek Mediterranean Cuisine Philadelphia Pa 19102

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

The Goal Line Pub West Chester Pa

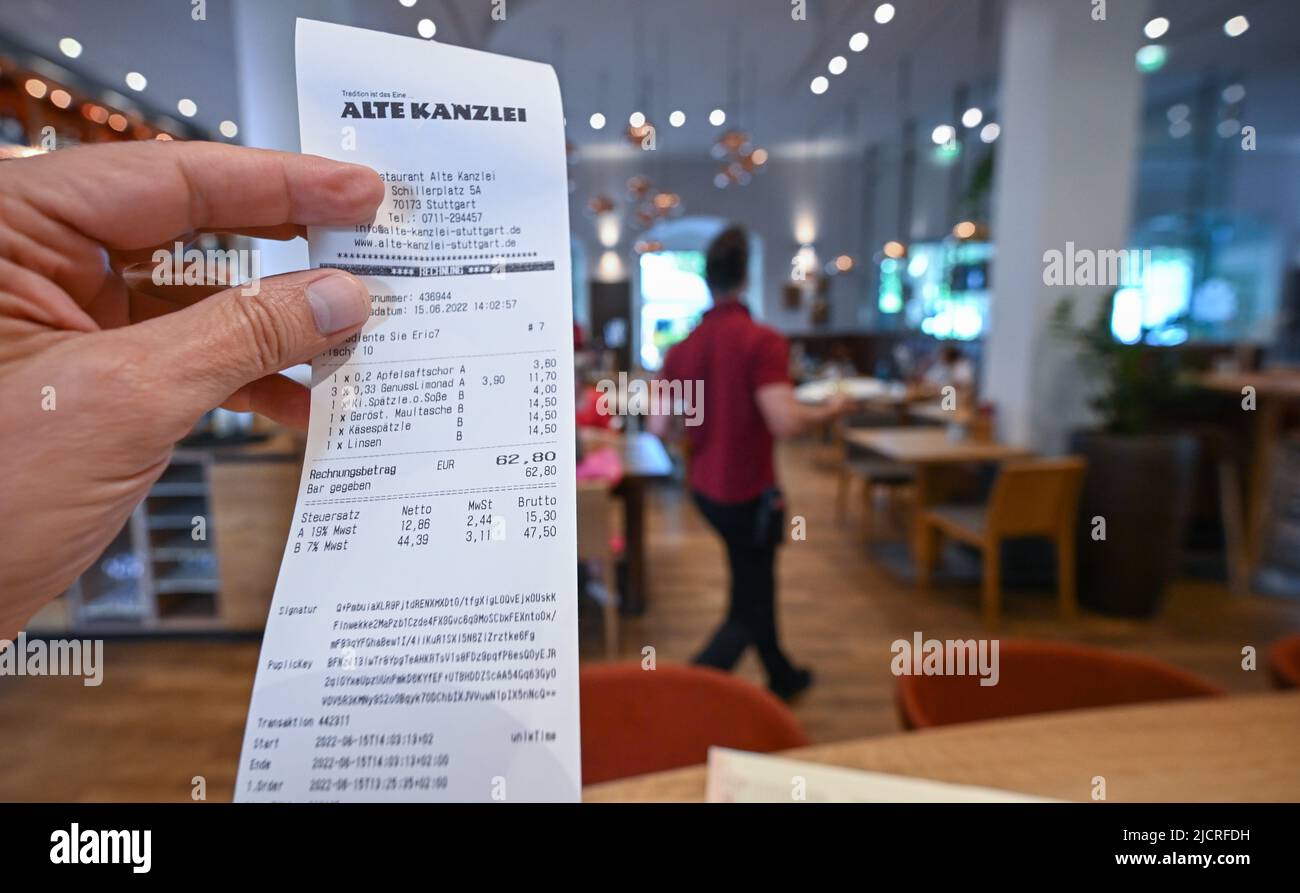

Stuttgart Germany 15th June 2022 A Hand Holds A Bill With Two Different Vat Rates For Drinks And Food In A Restaurant In Stuttgart Posed Scene Restaurateurs In The Southwest Plead For

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Vetri Cucina Restaurant Philadelphia Pa Opentable

How To Get Restaurant Licenses And Permits And What They Cost

Exemptions From The Pennsylvania Sales Tax

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation